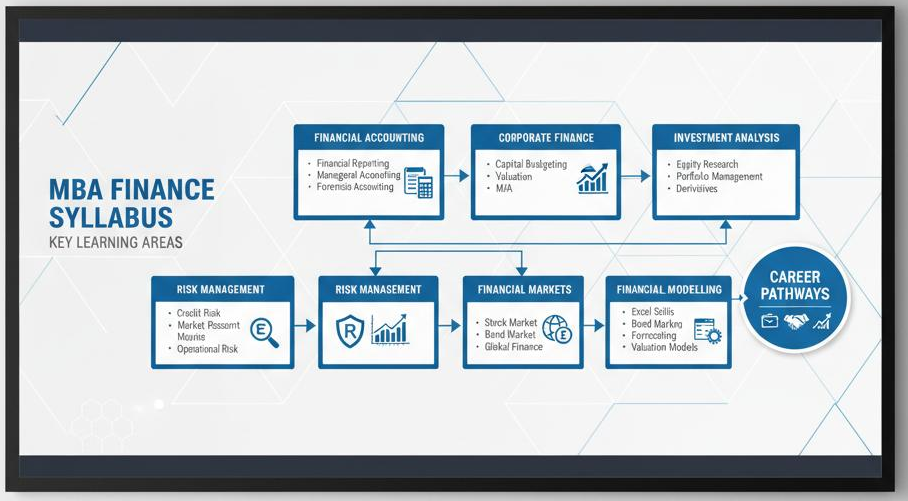

MBA Finance Syllabus Breakdown and Key Learning Areas *

Key Takeaways:

- Learn how the MBA Finance syllabus builds step-by-step expertise

- Learn how practical components give you an industry edge

- Learn how to choose the right MBA Finance programme for you

Given that the finance industry is very competitive, the postgraduate degree you choose could have long-term implications for your career. Therefore, it is essential to research the specialised MBA Finance syllabus and subjects to gain the focus and clarity you need to build your career in the future. This qualification will equip you with both the strategic vision and technical skills you need for investment banking, financial consulting, or corporate decision-making. The MBA Finance curriculum usually consists of a good balance of academic principles and practical skills, and the lessons will cover essential subject areas such as capital budgeting, risk analysis and financial accounting. Institutions are responding to and embracing the current global and digital changes, and many teach subjects like financial technology and sustainable finance practices in their MBA Finance courses. Additionally, many MBA finance subjects will also help you develop your leadership and problem-solving skills and will give you the ability to tailor your education towards a particular interest in your career.

This article discusses a typical MBA finance course curriculum, including core areas of study, to help you make an informed choice about your relevant educational and career path.

Understanding the MBA Finance Curriculum Structure

Before choosing an MBA in finance, it is essential to understand how the academic structure balances strong theoretical foundations with practical, industry-relevant experience. Most MBA finance programs in India and around the world are full-time, two-year courses. These are usually divided into four semesters. The first part of the program focuses on building core business knowledge, while the latter half allows for deeper specialisation and the opportunity to apply what you have learned in real-world contexts.

Year 1: Core Foundation (Semesters 1 and 2)

The first year of the MBA Finance curriculum lays the groundwork by introducing students to essential business and finance principles. Subjects commonly taught during this period include:

- Financial Accounting

- Managerial Economics

- Organisational Behaviour

- Marketing Management

- Quantitative Techniques

- Business Communication

Year 2: Specialisation and Application (Semesters 3 and 4)

In the second year, the emphasis shifts toward specialised topics and practical experience. Students dive into areas tailored to their interests and career paths.

- Advanced Financial Management

- Electives aligned with specific career goals

- Summer Internships

- Capstone or Dissertation Projects

- Live Industry Projects

Core and Elective Subjects in the MBA Finance Syllabus

- The MBA Finance syllabus blends both core and elective components, allowing students to first establish a strong foundational knowledge and later customise their learning journey based on their goals.

- Core subjects are mandatory for all students and cover key areas like corporate finance, financial markets, and strategic management, ensuring a shared understanding across the cohort.

- Elective subjects give students the flexibility to explore specialised fields such as fintech, international finance, risk management, or behavioural finance.

Practical Learning Components

A distinctive feature of the MBA finance programme is its focus on practical experience, including:

- Internships allow students to gain practical exposure in financial environments.

- Case Studies and Business Simulations are offered as development vehicles for decision-making and analytical skills.

- Live Projects are often conducted with partnerships in industry, enabling the student to create simulations in real business environments.

- Capstone or Dissertation Projects enable students to do in-depth research projects applying academic concepts to a multilayered financial problem.

Key 1st Year MBA Finance Subjects (Semesters 1 & 2)

Year one of the MBA finance syllabus covers foundational concepts in business, management and finance, and builds the analytical, strategic and communication skills students will need to progress to specialised finance roles.

Semester 1: Core Business and Financial Foundations

The MBA Finance subjects taught during the first semester focus on core business information as well as beginner finance topics. These are usually found in most of the renowned MBA finance courses.

| Subject | Focus Area |

| Principles of Accounting | Fundamentals of financial statements, ledgers, and accounting cycles |

| Microeconomics | Consumer and producer behaviour, supply and demand, pricing mechanisms |

| Quantitative Methods & Statistics | Data interpretation, forecasting, probability, and statistical analysis |

| Principles of Marketing Management | Market segmentation, consumer behaviour, and product positioning |

| Business Communication | Professional writing, presentation, and business dialogue |

| Organisational Behaviour – I | Leadership styles, motivation, group dynamics, and organisational culture |

| Corporate Social Responsibility | Ethical and sustainable business practices, stakeholder impact |

Semester 2: Strategic and Financial Skill Development

The second semester furthers the student's understanding of finance while introducing strategic thinking and industry-specific tools.

| Subject | Focus Area |

| Corporate Finance | Capital budgeting, cost of capital, financial planning, and risk analysis |

| Managerial Economics | Economic theories applied to managerial decisions and market strategies |

| Strategic Management | Competitive analysis, strategic frameworks, and long-term business planning |

| Financial Modelling | Building financial models using spreadsheets for forecasting and valuation |

| Business Intelligence | Use of data analytics tools to support business decisions |

| Supply Chain Management | Logistics, procurement, and distribution management |

| Marketing Research | Research design, data collection, and market insight generation |

| Corporate Governance & Ethics | Governance frameworks, board structures, and ethical decision-making |

Key 2nd Year MBA Finance Subjects (Semesters 3 & 4)

Building on the solid foundation laid in the first year, the second year of a finance-focused MBA elevates students into advanced financial analysis, strategy, and practical experience.

Semester 3: Deepening Financial and Strategic Expertise

| Subject | Focus Area |

| Capital Budgeting | Evaluating long-term investment decisions through estimation and assessment |

| Risk Management | Identifying and mitigating various financial risks |

| Working Capital Management | Managing day-to-day liquidity and operational finance |

| Principles of Banking | Fundamentals of retail and corporate banking systems |

| Models for Determining Optimal Cash Needs | Financial models to optimise cash allocations |

| Foreign Exchange Management | Managing currency risks and international financial exposures |

| Cash Management | Techniques for managing organisational cash flow |

| Macro‑Economics | Understanding economic indicators and their impact on financial decisions |

| Treasury Management | Overseeing an organisation’s treasury operations and financial assets |

| Management Control Systems | Designing and implementing performance measurement and control systems |

| Business Law | Legal frameworks that govern financial and corporate operations |

| Theories of Capital Structure | Exploring capital mix theories and their application in funding decisions |

| Business Policy & Strategic Management | Integrating finance with strategic business policy-making |

| Operations Management | Examining operational efficiency through process and resource planning |

| Corporate Management | Governance, leadership and strategic oversight within corporate entities |

| Optimisation & Project Research | Applying mathematical techniques to optimise financial decisions and projects |

Semester 4: Specialisation Through Applied Learning

| Subject | Focus Area |

| Capital Budgeting | Evaluating long-term investment decisions through estimation and assessment |

| Risk Management | Identifying and mitigating various financial risks |

| Working Capital Management | Managing day-to-day liquidity and operational finance |

| Principles of Banking | Fundamentals of retail and corporate banking systems |

| Models for Determining Optimal Cash Needs | Financial models to optimise cash allocations |

| Foreign Exchange Management | Managing currency risks and international financial exposures |

| Cash Management | Techniques for managing organisational cash flow |

| Macro‑Economics | Understanding economic indicators and their impact on financial decisions |

| Treasury Management | Overseeing an organisation’s treasury operations and financial assets |

| Management Control Systems | Designing and implementing performance measurement and control systems |

| Business Law | Legal frameworks that govern financial and corporate operations |

| Theories of Capital Structure | Exploring capital mix theories and their application in funding decisions |

| Business Policy & Strategic Management | Integrating finance with strategic business policy-making |

| Operations Management | Examining operational efficiency through process and resource planning |

| Corporate Management | Governance, leadership and strategic oversight within corporate entities |

| Optimisation & Project Research | Applying mathematical techniques to optimise financial decisions and projects |

Choosing the Right MBA Finance Programme

Choosing an MBA finance course goes beyond rankings; you want to find a programme that works for you and delivers results.

- Reputation & Placement: Institutions such as IIM Ahmedabad, Jagannath University (Jaipur) all provide solid training in core MBA finance subjects while having established placement networks in both local and global industries.

- Curriculum Relevance: You want to ensure that the MBA finance syllabus includes the core topics, but also examines whether there are emerging topics like FinTech, ESG or Risk management. An effective MBA finance curriculum should incorporate learning theory, practical application and current elective subjects.

- Faculty & Practical Learning: Programmes which are led by experienced faculty and include internships, case studies and practical financial tools will serve you far better in a competitive environment.

- Location Advantage: B-schools located in finance hubs such as Jaipur, Mumbai, Delhi NCR & Bengaluru offer an advantage in terms of proximity to internships and make job roles accessible to you.

Conclusion

An MBA in Finance not only equips students with information but also provides students with real-world experience, analytical planning and an awareness of the strategic role of finance in a business. An MBA finance programme includes core and advanced finance topics to provide students with a broad background and help them navigate their way through work opportunities in areas of corporate finance, investment banking, risk management, and the new and developing fields of FinTech and sustainable finance. With change happening so quickly in the financial system due to new technologies and regulations, the evolving MBA finance curriculum keeps students on their toes by blending traditional capabilities with new learning, and students will learn important MBA finance subjects that help facilitate the increased adaptability needed to future-proof their careers.

FAQs